The original idea was for this to be part of a presentation to the United Nations G77 conference in April. Sadly, for reasons we all know, that wasn’t to be. We will be reassembling in New York in 2021. Cuomo permitting.

What did we learn?

The prime reason for the Heath Report is to establish the availability of advice to the UK consumer. The most significant figure is the number of clients each adviser has; which we call the Client/Adviser ratio. That ratio multiplied by the number of advisers is the capacity of the Professional Advice Sector.

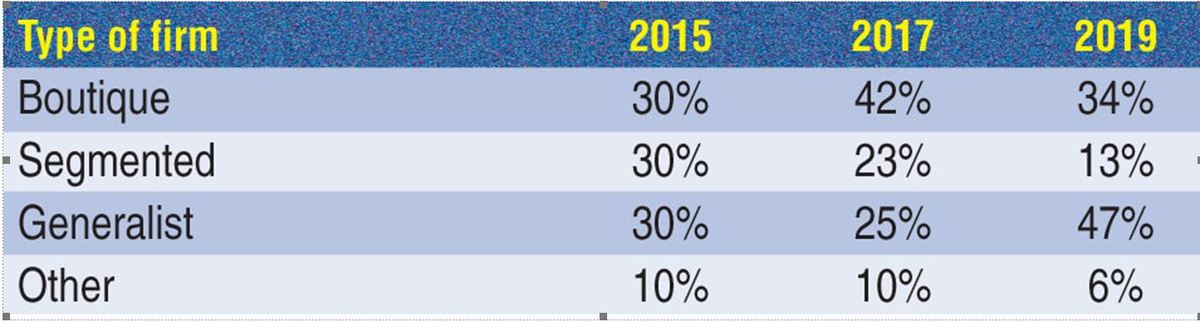

We also look at what type of distribution model each of our respondents embraces. These split into:

- Boutique – Small number of clients high levels of service

- Segmented - Different levels of service within one firm

- Generalist – These are transactional advisers. The Traditional IFA problem solver.

- Other – Usually firms in transition from one of the other 3 models

In 2015, the accepted wisdom was that post RDR; we could expect Boutique and Segmented market share to shoot upwards and Generalists to wither and die. This wisdom was supported to a degree by the THR3 survey in 2017.

THR 3.1 shows serious changes back to a somewhat pre-RDR climate. Boutique has had its flourish but is returning to 2015 levels. Segmented is less than half of its 2015 position. But big news is that the traditional or Generalist IFA is making a comeback.

Before RDR, the Ratio was 405 and capacity was 18m. It then dropped quickly through the 200’s to 180 in 2015. In 2017; the ratio was 160 which gave us a Sector Capacity of 5.3m. Our 2019 ratio figure is 186. This expands the Sector Capacity to 6.6.m which sounds good news, even if its 12m less than the pre-RDR figure*

*One small proviso. It may be that we have acquired a disproportionate number of generalist firms in the survey. If so, we may have overstated the capacity of the sector.

Are We Still Worried About the Number of Advisers Retiring? - Yes!

In 2017, IFAA identified that we would lose 1,650 advisers to retirement every year for the next decade. Our latest survey shows we have lost 1,833 advisers to retirement in the last 2 years. This may explain why we have not yet seen our anticipated drop in adviser numbers.

In addition, we have lost another 600 advisers who have stopped being advisers but stayed in the industry and over 2,200 advisers have moved around the sector.

In the latest survey, we also asked advisers their retirement plans. We now have 3,700 in the departure lounge keen to retire immediately. Another 6,600 plan to do so within 5 years. That is an increase of potential retirees from 1,650 to 2,000 pa until 2025

The issue we have with these numbers is that they are aspirational. Respondees may wish to retire but can they afford to? Similarly, in some cases those who imagined a longer career may have it curtailed by a decision made in the boardroom.

IFAA has spent a huge amount of time attempting to create “Adviser Train” which would use the Government Apprentice Scheme to fund adviser training. This has hit the buffers thanks to a bizarre application of the benefits in kind rule.

We have asked advisers how many have trained advisers successfully and it was 40%. The remaining 60% are not only not training but no even looking for trainees. If we are to replace circa 2,000 advisers pa, each willing firm will need to have 2 trainees in tandem.

What advisers worried about?

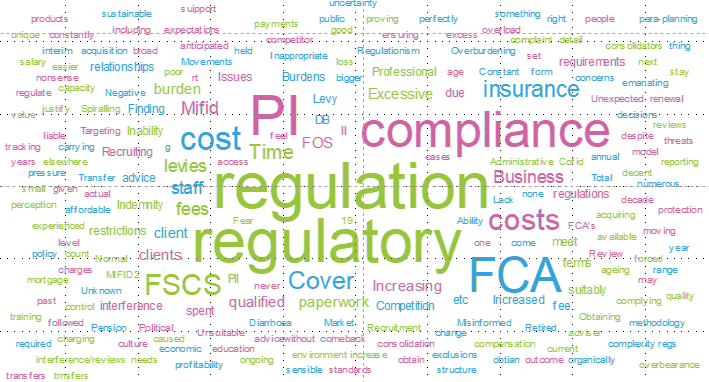

Finally, we asked advisers the top three most important issues and requested the answers in free form. We therefore got the same type of answer expressed slightly differently.

No 1 – Regulation/ FCA / Regulatory.

No 2. - Professional Indemnity.

No 3. – Compliance

These results speak to the bizarre nature of the Professional Advice business. Most commercial firms would worry about cashflow, the bank, sales, production or employment.

Advisers worry about Regulation, P.I. and Compliance. Three issues that do not emanate from customers and are wholly parasitic on the practice of giving advice. They do not add to the process. They just take from it and cost the client way in excess of 20%

In some ways, the advisers are missing a point. Regulation and compliance are relatively small beer to a FOS claim but many advisers have yet to be hit by a sizeable FOS claim and therefore have yet to understand the importance. The FCA can stop you trading. FOS can take your house.

So how did advice get this bizarre? Because advisers let it. Initially, advisers were too busy getting themselves entrapped on faux professional standards. Insurance Brokers versus consultants. Financial Planners versus IFAs. The siren voices of division were more attractive than unity.

For a time in the 80s, advisers created enough unity to push back against those who sought to destroy advice. We stopped the producers invading advice and called into question the antics of the banks. All against the serried ranks of the lobbyists from the big battalions.

Then, we realised we needed to unite against the bigger enemy. Those who wished to see our fellow citizens remain unadvised or exploited. We did this not only in the UK but across Europe with great success. We also ensured some of regulation’s more impractical fetishes never saw the light of day.

Until the IFAA/Libertatem re-emerged, for 2 decades, we didn’t fight or unite, just cowered Chamberlain-like under a blanket of appeasement. Advisers deserve better. More importantly, Clients deserve better.